Are Turkish Sporting Guns Now a Better Deal Than Ever?

With the European Union and Japan facing at least a 20-percent tariff, our favorite sporting gun makers in Italy, Germany and Japan could see price increases that cut deep into household budgets for hunters and clays shooters considering entry-level or mid-priced shotguns – raising the question: are Turkish shotguns suddenly a phenomenal deal?

Sporting guns made in Turkey have long suffered a reputation for inferior quality. Although their cheap prices were a lure, in the end it was often the case of getting what you pay for. A $400.00 Turkish over/under would have a tough trigger and manufacturing tolerances that could often be described as parts flying in close formation.

Even if your money was tight or you were looking for a knock-about or first shotgun for junior, people often shrugged off Turkish shotguns and took the leap to entry-priced over/unders and semi-automatic shotguns from the likes of Europeans such as Beretta, Fausti, Rizzini, F.A.I.R. Caesar Guerini, Fabarm or Benelli. With President Trump’s proposed tariffs, a Fabarm semi-auto posting a manufacture’s suggest retail price of about $2,400, a 20-percent tariff would add nearly $500 to the purchase.

The Pointer Side by Side from Legacy Sports International.

The Yale University Budget Lab reported in April that the proposed tariffs would reduce household purchasing power by an average $4,400 annually. Let’s say you supported a family of four in Arkansas, your annual income would hover around $68,000. With the Consumer Price Index reporting 23.6-percent inflation of food costs between 2020-2024, that $500 tariff penalty could mean abandoning your first choice of a European sporting gun and instead taking a closer look at a traditionally less expensive alternative from Turkey, which is only facing a potential 10-percent tariff.

As of now, the EU and Japan tariffs proposed by the Trump administration are under a sweeping 90-day suspension. Regardless, experts are presuming international tariff negotiations to end with some sort of surcharge that inevitably gets passed on to American consumers – meaning that Turkish over/under with a suggested retail price of $500 goes up a nominal $50 under the current schedule.

At this point, not expecting any impact on European or Japanese sporting shotguns prices would fall under the classification of wishful thinking.

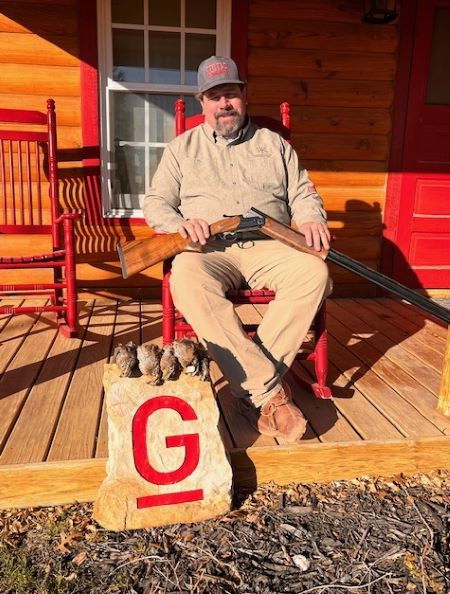

Matt Nelson

“Turkish guns are the best deal on the planet right now” said Matt Nelson, Sales Director of the Turkish-made Webley & Scott shotguns based in Baird, Texas. “We were already 30-to-50 percent cheaper than the Europeans and Japanese and now we’ll be about 60-percent cheaper.”

For example, Webley & Scott sells a 20/28-gauge combo over/under for $2,499. “A similar combo set from Beretta before the tariffs is $4,800, already 48-percent more expensive,” he added. “A 20-percent tariff would add, let’s say, close to $1,000 to the Beretta.”

The Webley & Scott combo.

Matt said that since the proposed Trump tariffs made headlines “We’ve been hearing from dealers about stocking our Webley & Scotts. My email has already blown up this morning. Right now Webley & Scott has over 150 stocking dealers in the U.S. and we’re in the process of signing up three national distributors. We’re hoping for another 25-to-30 percent growth this year.

He added that they are currently holding pricing for six months to see what happens with the tariffs on the four models they are importing that start at around $1,299.

Another Turkish shotgun venture is underway led by Dave Miller. He has close to 20 years experience dealing with Turkish shotgun makers. Formerly the Shotgun Product Manager with CZ-USA, Dave along with two other departed CZ-USA key executives, have formed a new company called Akkar USA headquartered in Kansas City, Missouri. In addition to Huglu, Akkar supplied CZ with shotguns. Dave knew the company manufactured high-quality, value firearms and made the logical leap to establish Akkar USA as their importer and distributor in America.

Dave Miller

He pointed out that, while the anticipated tariffs would certainly impact segments of the new sporting-gun marketplace, people on the margin of affording European shotguns or Japanese-made Brownings would turn to the used gun market, where their increased demand will probably force up those prices.

“The prices of used guns are likely to increase to fill the gap, along with the higher prices to repair used guns, given the prices of parts,” he explained. “So doesn’t it make sense to buy a new Turkish shotgun that comes with a factory warranty?”

As far as Dave is concerned, the numbers speak for themselves.

“Think about this,” he said. “Browning shotguns have about 39 percent of the target-gun market. If Browning Japan doesn’t negotiate a deal on tariffs, the blue-collar guy who was buying a $2,500 shotgun is now facing a potential increase of 24 percent. Even the average cost of a plain Browning CX is about $2,000, and that price could jump another $400-to-$500 with the tariffs. The price of our new Akkar target guns will be about $1,000, and we’ll be keeping our price list consistent. If I were someone looking to get a gun that’s a good value that’s what I’d look for.”

When we spoke with Chad Peters he was furiously attacking his spreadsheets in anticipation of the new tariffs. He’s the Customer Service, Conservation and Territory Sales Manager at Legacy Sports International, the Reno, Nevada-based importer of the Pointer family of shotguns, along with other offshore brands of rifles, pistols and accessories.

“The paperwork, it’s me being ahead of the game,” he said. “Our prices are not increasing overall, but there will be a line item adjustment. It would be a surcharge. What we’re working on now is keeping the prices as low as possible. Our customer service team, which deals with wholesalers and distributors, is asking if they should buy their guns now before hunting season starts. People are already planning.”

Chad Peters

Chad continued that “the tariffs will not affect the number of guns we import, but could affect lead time. Now, we air freight our guns, but we could turn to sea freight to help offset the cost. Our sales are ramping up every month, and because of demand it’s hard for us to keep the over/unders in stock. But I’ve heard that some of the Turkish gun makers are ramping up production.”

Increased production comes at an opportune time for the Turkish shotgun industry simply because it now has the wherewithal to ship higher quality products in mass-market quantities.

Most Americans don’t realize that Turkey has a large defense industry. As NATO’s second-largest standing army, it has also become an important weapons exporter. Turkey’s 2024 defense exports totaled $7.1 billion – a 29-percent increase over 2023, according to the country’s Defense Industry Agency. The Turkish defense sector reaches about 180 countries that need sophisticated technologies such as drones, war ships and electronic-warfare systems. Why does this matter to the weekend warrior in the dove fields?

The RT25 made by Kizilkaya is a Beretta DT11 clone being imported by Matt Nelson of Webley & Scott.

Because Turkish military research and development efforts, as in other countries, often translates into benefits for smaller manufacturing, healthcare and consumer companies. It could be likened to the federal American Defense Advanced Research Projects Agency (DARPA) whose military innovations spawned civilian staples including GPS, personal computer, microwave oven, the Internet and vaccines.

Likewise, when applied to sporting shotguns made in Turkey, the precision machinery that designs, fabricates and assembles warfare products can be commercialized through the rapid adoption of CNC machinery, computer-aided design software and other factory-floor advancements enjoyed by the military.

Turkey’s military know-how, when applied to the country’s shotgun industry, yields standardized, precision-made components that keep down prices while improving reliability – furthering their value proposition against the European and Japanese counterparts.

The Pointer Acrius over/under field gun.

There has been an evolutionary adoption to more durable materials such as lightweight alloys and state-of-the-art polymers. For the hunter and clays shooter, the impact of Turkey’s military on shotguns is capable of delivering products that are lighter, and more reliable and nimble than previous generations, that are capable of withstanding extreme weather conditions and semi-professional tournaments volumes.

Turkey’s shotgun industry has come along way from its cottage-industry roots. Cheap hand labor is surpassed by digital manufacturing and design complemented by better materials. Its reputation for making crumby, cheap shotguns has evolved into sporting guns now costs upwards of $7,000 that compete against established brands. In turn, Turkish shotguns are gradually moving beyond their shabby origins. All you have to do is track the history of leading Turkish shotgun makers such as Huglu, Kizilkaya, Akkar, ATA, Yildiz and Hatsan.

The Turkish shotgun industry is already integrating the traditional craftsmanship of hand finishing with modern manufacturing methods, creating shotguns that compete on more than price alone with their European and Japanese rivals.

Dave had mentioned that he’s now seeing Turkish shotgun companies with their own metallurgy laboratories.

“Turkey is producing over 80 percent of the shotguns in the world and I believe they are going to control the market, if not increase their market dominance, going forward,” Matt said. “Since dealing with our manufacturing partners, I’ve seen constant improvement with guns coming out of Turkey.”

Irwin Greenstein is the publisher of Shotgun Life. You can reach him via the Shotgun Life Facebook page at https://www.facebook.com/shotgunlife#

Helpful resources:

The web site for Legacy Sports International

Irwin Greenstein is Publisher of Shotgun Life. Please send your comments to letters@shotgunlife.com.

Comments